The Reserve Bank of India maintains the repo rate at 6.5 percent and revises GDP growth for FY25 down to 6.6 percent. Inflation forecast is raised to 4.8%.

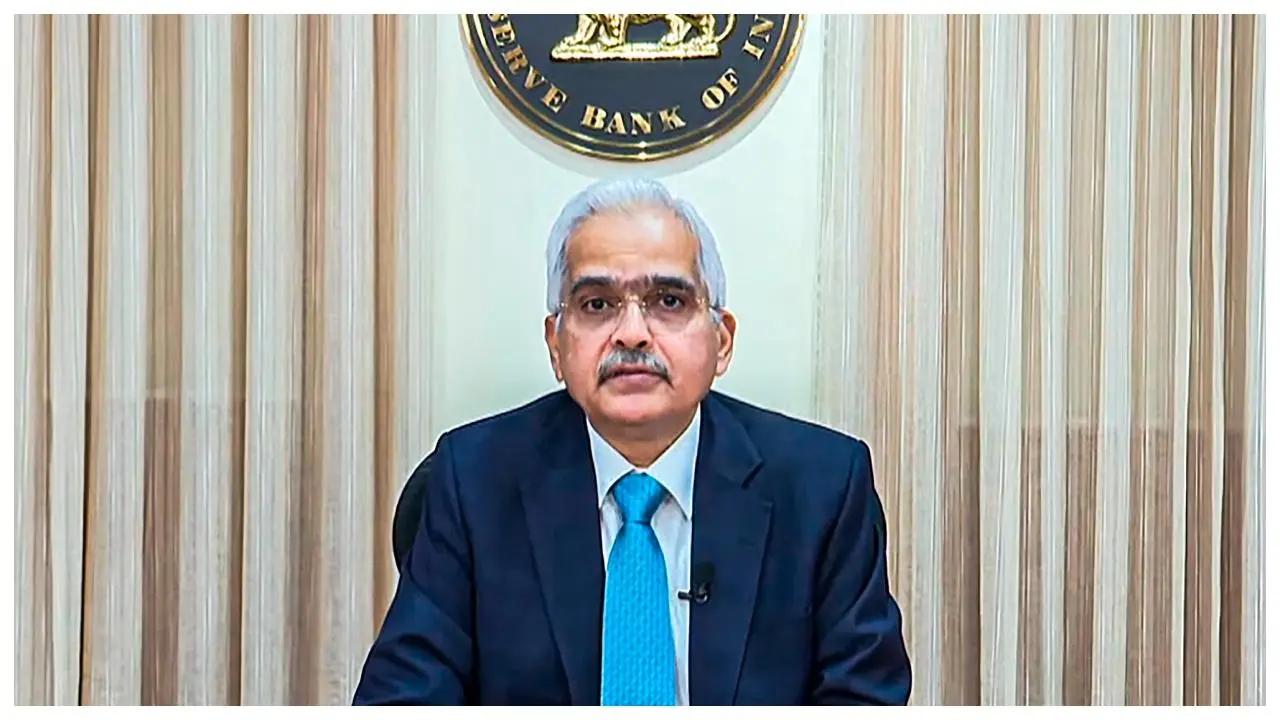

File Pic

The Reserve Bank of India (RBI) has decided to maintain the repo rate at 6.5% for the 11th consecutive time, continuing with its neutral monetary policy stance. The decision, made by a 4-2 majority during the Monetary Policy Committee (MPC) meeting on Friday, aims to keep inflation within target levels while supporting economic growth.

ADVERTISEMENT

Governor Shaktikanta Das, addressing the media, stated that as a result of the decision, the Standing Deposit Facility (SDF) rate remains at 6.25%, and the Marginal Standing Facility (MSF) rate, along with the Bank Rate, stays at 6.75%. This policy move reflects the RBI’s cautious approach in balancing inflation control and economic expansion.

In a significant update, Das also revised the country’s GDP growth projection for the financial year 2024-25, lowering it to 6.6% from the previous estimate of 7.2%. The revised projection indicates a moderate growth trajectory for the economy in the wake of recent inflationary pressures and global uncertainties. The RBI now expects real GDP growth for the third quarter of FY25 to be 6.8% and for the fourth quarter to reach 7.2%. The first quarter of 2025-26 is forecasted to see a growth of 6.9%, while the second quarter is expected to expand at 7.3%.

The central bank also announced a cut in the Cash Reserve Ratio (CRR) by 50 basis points, reducing it from 4.5% to 4%. This change is expected to inject liquidity of approximately ₹1.15 lakh crore into the banking system, aiming to support lending and economic activity.

However, inflation projections have been revised upwards for FY25, with the RBI now forecasting inflation at 4.8%, up from its earlier estimate of 4.5%. The adjustment reflects persistent inflationary pressures in the economy, though the central bank continues to prioritise price stability.

Despite these economic challenges, Governor Das expressed confidence in India’s overall economic trajectory. "India has been growing at over 8% GDP growth in the past three years, and despite the recent challenges, it continues to progress on a balanced path towards sustained growth," he remarked.

Das also emphasised that India is well-positioned in the evolving global economic landscape. "Amidst the global economic shifts, India remains in a strong position to leverage emerging trends and continue its transformative journey," he added.

The RBI’s commitment to maintaining a neutral stance reflects its ongoing focus on aligning inflation with its target while supporting economic growth. As per ANI and PTI reports, the market will now closely monitor the impact of these measures on inflation and GDP growth in the coming quarters.

(With inputs from ANI)

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!