Some hit pause after govt’s ready reckoner rates make some areas pricier, others rush before prices climb further

Maharashtra government announced a hike in Ready Reckoner (RR) rates. Representation pic/istock

Owning a dream home in Mumbai has just become costlier, prompting many buyers to put their plans on hold. The Maharashtra government, late Monday evening, announced a 4.3 per cent hike in Ready Reckoner (RR) rates across the state for the financial year 2025-26.

ADVERTISEMENT

Legal experts weigh in

According to real estate lawyer Advocate Dharmin Sampat, “In Mumbai City Jurisdiction, areas like Malabar Hill, Cumballa Hill, Fort, and Worli have seen a marginal increase in RR rates. However, Mahim, Dadar, Girgaum, Bhuleshwar, and Sion have witnessed a sharp rise of approximately 10 per cent, indicating a sudden surge in property valuations.”

Sampat pointed out that several redevelopment projects are struggling due to a lack of buyers. “In some areas like Ghatkopar East, Tilak Road, and Pant Nagar, property prices have fallen by over 20 per cent, despite rising construction costs. This shows that, in today’s market, investors prefer stocks and gold over real estate. The average return on residential property investment is around 3 per cent, which is even lower than inflation. In my view, real estate investments are yielding negative returns, which is a troubling sign. Many builders might fail to honour their commitments, especially in areas where FSI is as high as 10, leading to an oversupply and further price drops.”

He further explained, “RR rates, also known as the Annual Statement Rate (ASR), determine the market value of immovable property and form the basis for calculating stamp duty under the Maharashtra Stamp Act.” Stamp duty is a key revenue source for the Maharashtra government. “The state’s 36 districts, divided into eight regions including Mumbai, Thane, Pune, and Nagpur, are under the jurisdiction of the Deputy IGR. In 2024-25, 13,40,464 documents were registered, generating Rs 35,858.54 crore in revenue,” Sampat added.

Advocate Vinod Sampat, president of the Registration Fee & Stamp Duty Payers Association, painted a bleak picture for real estate. “The days of property being a lucrative investment are over. The government acts as a silent partner to builders, collecting 50-60 per cent of payments made by homebuyers through stamp duty, GST, land taxes, and other premiums,” he said.

Homebuyers rethinking

“I was looking for houses in Andheri but will now consult my financial advisor before proceeding. I need to assess the impact of higher stamp duty on my budget. If the increase is manageable, I will continue my search,” said Sahil Chaphekar, a software engineer. Naitik Kapadia, a wedding-wear shop owner from Dadar, echoed similar concerns. “I need to re-evaluate my finances before making a decision. I don’t yet know how much this will affect my budget,” he said.

Others push ahead

However, some homebuyers remain unfazed. Nishad Shukla, who plans to buy a house in Ulwe, said, “Property rates only go up. Delaying this decision will mean paying even more later.” Sheetal Patole, a 32-year-old banker, agreed. “Whether I buy a house for R50 lakh or R1 crore, I will still take a loan. Waiting won’t help, as prices will only appreciate further,” she said.

Industry experts weigh in

Arpit Jain, director at Arkade Developers Ltd, noted that mid-range and luxury buyers might absorb the increased costs, but developers may need to adjust pricing strategies to maintain sales momentum. “Mumbai, which has seen a 3.4 per cent RR rate hike, may experience measured adjustments due to its already high property values,” he said.

Affordable housing hit

Anuj Puri, chairman of Anarock Group, warned that the hike could impact affordable housing the most. “Higher upfront costs, stamp duty, and registration fees make home ownership less viable for lower-income buyers. Developers may struggle to balance affordability and profitability, slowing down new projects,” he explained.

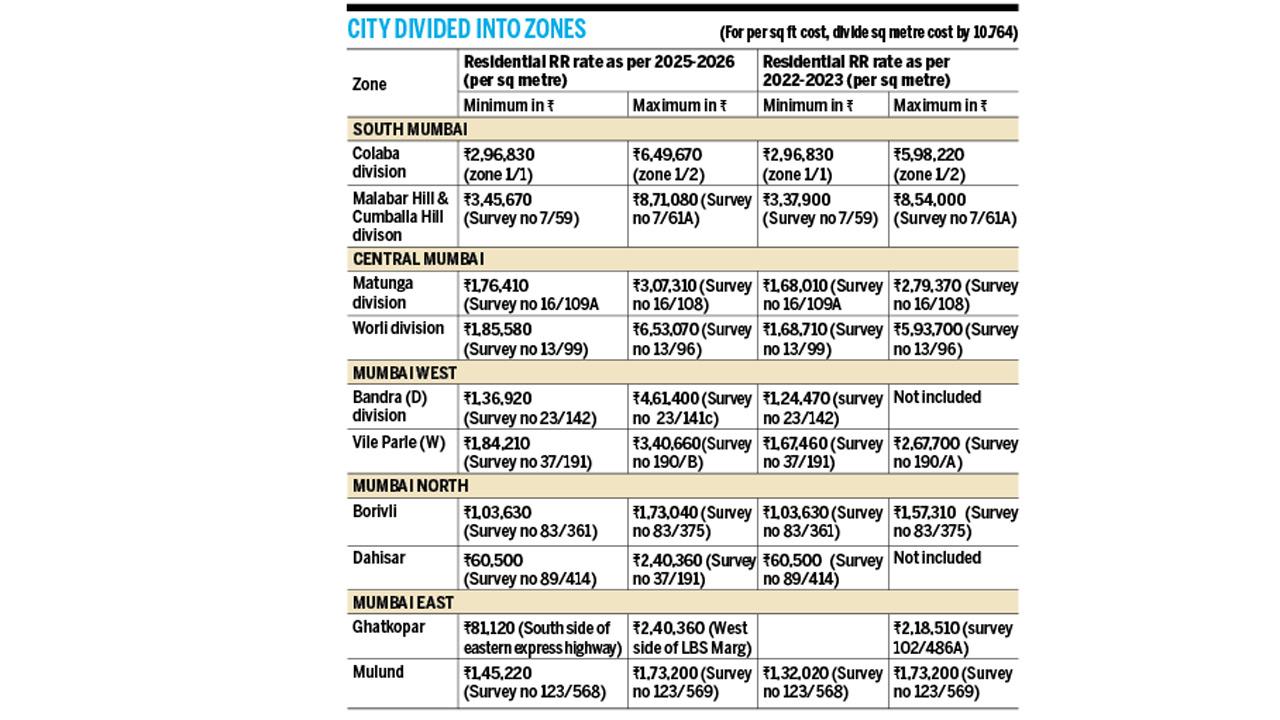

Zone-wise impact in Mumbai Effective 01.04.2025 – 31.03.2026

Total sub-zones: 352

76 new residential sub-zones added

Rates reduced by more than 10%: 1 sub-zone

Rates reduced up to 10%: 3 sub-zones

Rates reduced up to 5%: 13 sub-zones

No change in rates: 66 sub-zones

Rates increased up to 5%: 55 sub-zones

Rates increased up to 10%: 137 sub-zones

Rates increased by more than 10%: 1 sub-zone

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!