Say the accused used to lure gullible investors via seminars promising high returns

Valentina Kumari (an OCI national) and Tania Kasatova, an Uzbekistan citizen, arrested by the police. Pics/Ashish Raje

The Shivaji Park police have arrested three people—the director of a jewellery brand, an Overseas Citizen of India (OCI) and a citizen of Uzbekistan—for allegedly duping investors of R13.48 crore through a Ponzi scheme. The accused lured victims with promises of high weekly returns, exclusive offers, and rewards for referrals via a flashy app. An look-out circular (LOC) has been issued against two absconding accused who are suspected to have fled the country.

The arrested individuals include Sarvesh Surve, the company director, Valentina Kumari (an OCI national), and Tania Kasatova, an Uzbekistan citizen. Police suspect the fraud’s scale could exceed Rs 700 crore, with statements from victims still being recorded.

ADVERTISEMENT

Sarvesh Surve, the company director, arrested by the cops

The scheme targeted investors through a jewellery brand named Torres, which operated six stores in Mumbai, including branches in Dadar, Girgaon, Sanpada, Mira Road, and Kandivli. Investors were lured via the company’s app, “Torres Club,” which displayed investment statuses and promised weekly returns.

Investor accounts

Janardhan Gawandi, an investor, said, “We trusted the scheme because we were receiving regular returns until December. The company even planned a one-year anniversary celebration and promised to gift flats to investors. But suddenly, they shut operations, and we are panicking.”

Investors gathered outside the Torres Jewellery store in Dadar

Pradeep Vaishya, a vegetable vendor and the complainant in the case explained how he was duped of R4.5 crore. “I initially invested R2 lakh after visiting their Dadar store opening in February last year. They promised 6 per cent returns, which increased to 10 per cent later. As Torres expanded, opening five more branches, trust grew. But in December, an employee informed us the company was shutting down, and the CEO assured salaries would be paid. By January 6, the store was shuttered, and we approached the police.”

Vaishya added that he had taken loans to invest further in the scheme, which promised lucrative returns for buying moissanite stones. Gawandi elaborated on the app’s functioning: “The Torres Club app displayed our investments and weekly returns. It also rewarded us with R6,000 for bringing in new investors. I convinced many people to join and was earning Rs 25,000 monthly. Now the company is gone, and we’re left in despair.”

Investors outside Shivaji Park police station. Pics/Ashish Raje

Investors outside Shivaji Park police station. Pics/Ashish Raje

Faizan Khan, another victim, shared, “Each moissanite stone had a return rate. When targets were met, we received coupons. They called us their brand ambassadors during their seminars offline and on YouTube, but now they’ve absconded, and their shops are shut.”

“We are residents of Mankhurd, and our family invested R10–15 lakh in the scheme. Initially, we received returns as promised. The company claimed we would get returns for up to 52 weeks, but now everything is very uncertain,” said Nilima Sandeep Kadam, another investor. “Our family invested R3 lakh after seeing other family members receive returns. Tempted by the promise of huge profits, I decided to invest. But on January 6, the shop was shut, and now we are panicking,” said Abdul Shaikh, a makeup artist.

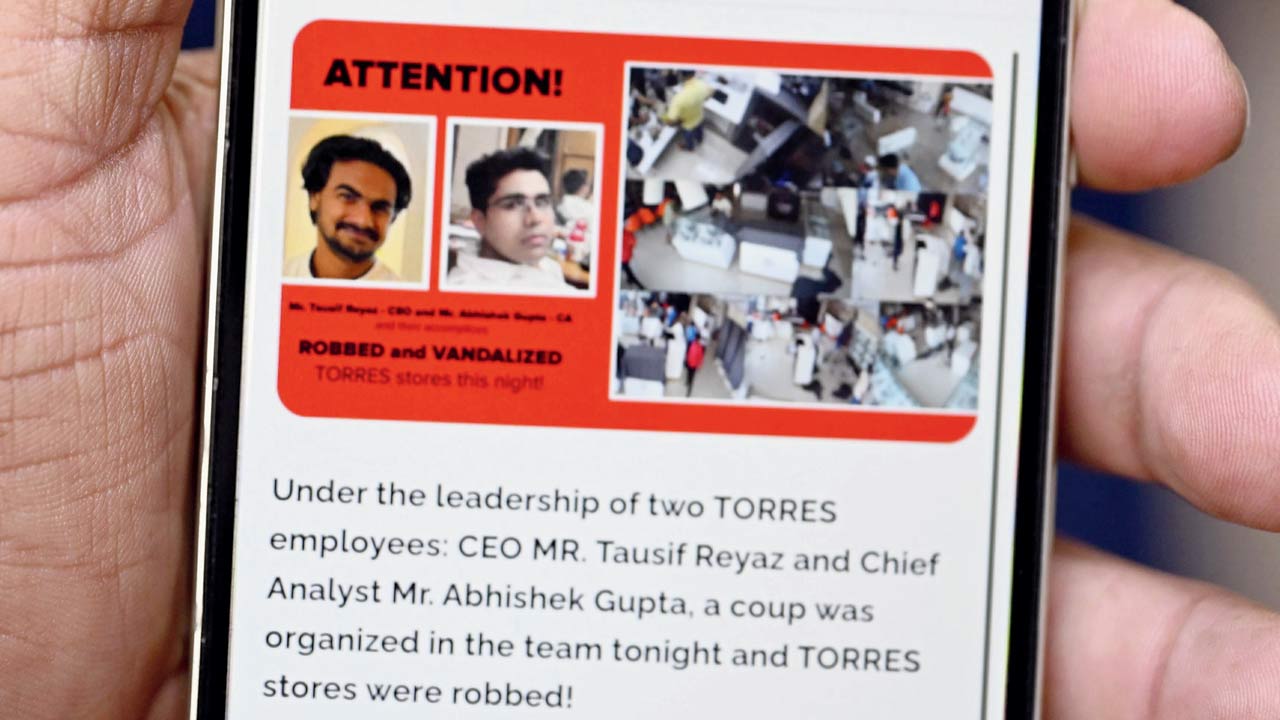

Torres app now displays a notice claiming its employees looted their shops

Police investigation

The Shivaji Park police revealed that Sarvesh Surve’s identification documents were used to make him the company director and beneficiary. The other two arrested women were employees. An LOC has been issued against two absconding accused. A police official stated, “We suspect the scam to be worth R700 crore, and the amount may increase as more victims come forward to register complaints. Torres stores in Dadar, Girgaon, Sanpada, Mira Road, and Kandivli were operational until recently.”

Torres’s claims

Interestingly, the Torres app now displays a notice claiming its employees looted their shops. The notice urges investors to register complaints against an individual named Abhishek, allegedly involved in a robbery at one of their branches. Torres has promised to return the investors’ money, but the claims remain unverified. Five individuals have been booked under relevant sections of the Maharashtra Protection of Interest of Depositors (MPID) Act, 1999.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!