If you're thinking of investing savings, here's why you should opt for Bajaj Finance FD!

Bajaj Finance

With the economic slowdown and rising inflation, it is natural for you as an investor to be cautious with your money. With the consumer price inflation for January 2020 recorded at 7.59%, the highest since May 2014, having a way to earn steadily to enjoy inflation-beating returns is key to growth. Otherwise, inflation will erode the value of your money over time. Further, following the recent RBI monetary policy review, leading banks across the nation dropped their FD interest rates, putting greater strain on the already nominal credit growth of just 7%.

ADVERTISEMENT

While the repo rate was left unchanged at 5.15%, the monetary policy committee (MPC) has launched long-term repo operations (LTRO). Through this, RBI will lend Rs.1,00,000 crore to banks at its policy repo rate, 5.15%. Experts say that while it is a masterstroke toward growth, it is also likely that bank deposit rates will fall in response. The LTRO is in effect as of February 15, 2020, and may also lead to a decrease in the yield of small savings schemes.

As a result, you may find yourself looking for a solution that can put you ahead of these changes and aid with wealth generation. Thankfully, the Bajaj Finance Fixed Deposit is a strong investment option and can bring in returns effortlessly. To gain an insight into its value, here are 3 reasons to invest your savings in this FD.

Earn interest returns in a safe and reliable instrument

When the goal is wealth generation without risk, going for the option with the highest interest rate offering may not always be the best approach. For example, co-operative banks were the go-to for their higher FD rates; however, the PMC bank fraud leads to losses of up to Rs.4,300 crore and caused distrust between investors.

To avoid such circumstances, picking an option that has a history of stability and credibility is key. The Bajaj Finance FD is one such offering and it has the highest ratings as proof. It has secured both the CRISIL 'FAAA' rating and the ICRA 'MAAA' rating. In addition, Bajaj Finance is the only Indian NBFC to have the international 'BBB' rating from S & P Global.

Take advantage of generous interest rates for better proceeds

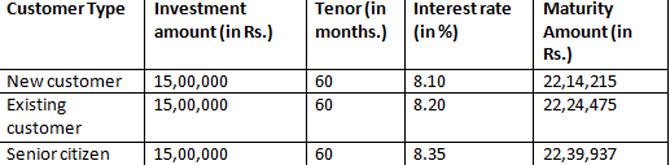

With major banks dropping interest rates to as low as 5.50%, earning optimal results in the current market can be a challenge. However, with a Bajaj Finance FD, you can get up to 8.10% as a new customer and up to 8.35% as a senior citizen investor. This has a very noticeable impact on your earnings and also plays a key role in combating inflation effectively.

To help you understand this better, here is an example of what you can expect to earn:

All the above-mentioned results were calculated using the FD Calculator.

Achieve saving and investing goals with the Systematic Deposit Plan

A particularly handy feature of the Bajaj Finance FD is that you can opt for the Systematic Deposit Plan and change way you invest altogether. Through this, you no longer have to commit a large lump sum. Instead, you can start investing with as little as Rs.5,000 per month. Here, you can make anywhere between 6 and 48 deposits and each monthly payment counts as a new FD with the prevailing interest rate.

Along with these advantages, the Bajaj Finance FD also allows you to take a loan against FD when you need access to liquidity. You can also opt-in for the Auto-Renewal feature for seamless reinvesting at maturity, should you want your corpus to continue to generate wealth. Here, you don't have to fill any additional forms and you can also benefit from the FD renewal bonus. Currently, you get an additional 0.10% on the base interest rate offered for renewing your Bajaj Finance Fixed Deposit. To start your investment in the Bajaj Finance Online FD, simply fill the form to hear from an authorised representative and enjoy assured.

Catch up on all the latest Crime, National, International and Hatke news here. Also download the new mid-day Android and iOS apps to get latest updates

This story has been sourced from a third party syndicated feed, agencies. Mid-day accepts no responsibility or liability for its dependability, trustworthiness, reliability and data of the text. Mid-day management/mid-day.com reserves the sole right to alter, delete or remove (without notice) the content in its absolute discretion for any reason whatsoever

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!