Three AI-based solutions by a start-up tackle challenges faced by businesses and organisations, including recruitment, sales and focused marketing

Hitul Mistry

On an average, recruiters spend 31 per cent of their time screening candidates, which could be better utilised elsewhere. Delays caused by unexpected leave, public holidays, and new recruit training can exacerbate this time loss,” shares Hitul Mistry, founder of Digiqt Techhnolabs. The 32-year-old’s recently-launched AI tool introduces what they call a candidate scoring system.

ADVERTISEMENT

Mistry’s recent venture uses AI to recruit employees

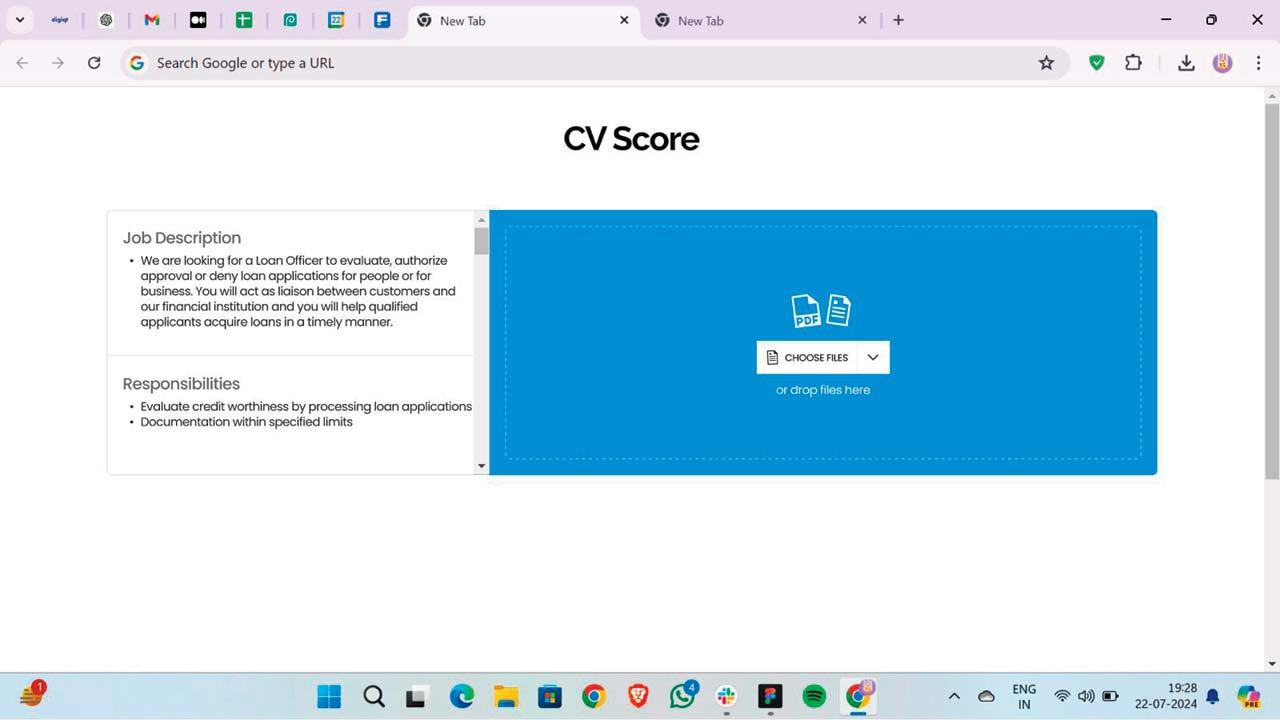

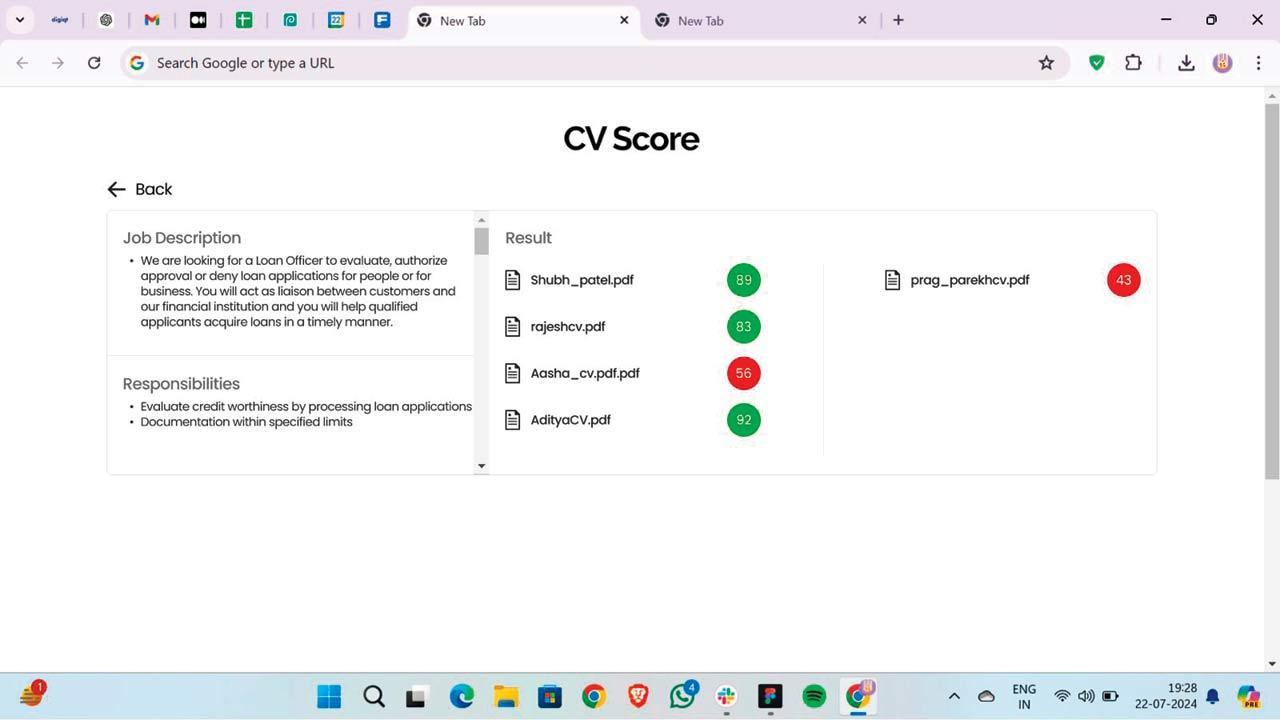

Mistry explains, “Unlike humans, AI can screen candidates 24/7 without bias towards attributes like university or location, focusing solely on qualifications and skills listed in job descriptions. Our innovative solution features a web-based interface where HR can effortlessly upload job descriptions and candidate curriculum vitae (CVs) in pdf or doc formats. Once uploaded, the system generates a score out of 100 for each candidate, streamlining the screening process. Under the hood, a sophisticated CV data extraction nlp algorithm transforms unstructured CV data into a structured format, storing it in a vector/document database. The structured data is then matched against job descriptions.”

The AI scores each candidate based on job requirements, responsibilities and qualifications

This, he says, reduces unconscious bias, and ensures consistent screening. AI can also scale efficiently to handle large volumes of CVs, as seen during increased attrition rates in the COVID-19 pandemic, maintaining performance without delays. “Such delays, often up to 10 days, can lead to a 10 per cent loss of ideal candidates who accept other job offers. With AI, priority screening and consistent turnaround times eliminate backlogs, resulting in a quicker and more efficient screening process.”

The turning point

The chat bot acts as 24/7 sales assistant that can solve the agents’ doubts throughout the day

The Ahmadabad-born software engineer currently works out of an office in BKC with his sales team and IT engineers. Passionate about solving business problems through technology, he discovered a gap at his initial jobs at an insurance broking firm. “I managed terabytes of data and provided various teams with crucial business reports and insights. One day, during a conversation with the business team [of the firm], I discovered that they often had more leads than the call centre could handle, resulting in prioritising the wrong leads. This issue significantly impacted their conversion rates. On noticing this challenge, I began learning about AI and implemented a Proof of Concept (POC) on a small subset of leads. This solution dramatically improved the call centre’s productivity. Since then, I have delved deeper into AI, driven by the desire to harness its potential to solve complex business problems.

Personalised AI videos help improve insurance pitches as per the customer’s requirements

Other projects by Digiqt Technolabs include a sales virtual assistant and an interactive AI video. While the former, he says, supports field sales heads and provides 24/7 instant responses to agents’ questions, the latter is an interactive video solution that personalised content for each customer. This, too, was inspired by a problem he faced personally.

Focus on the solution

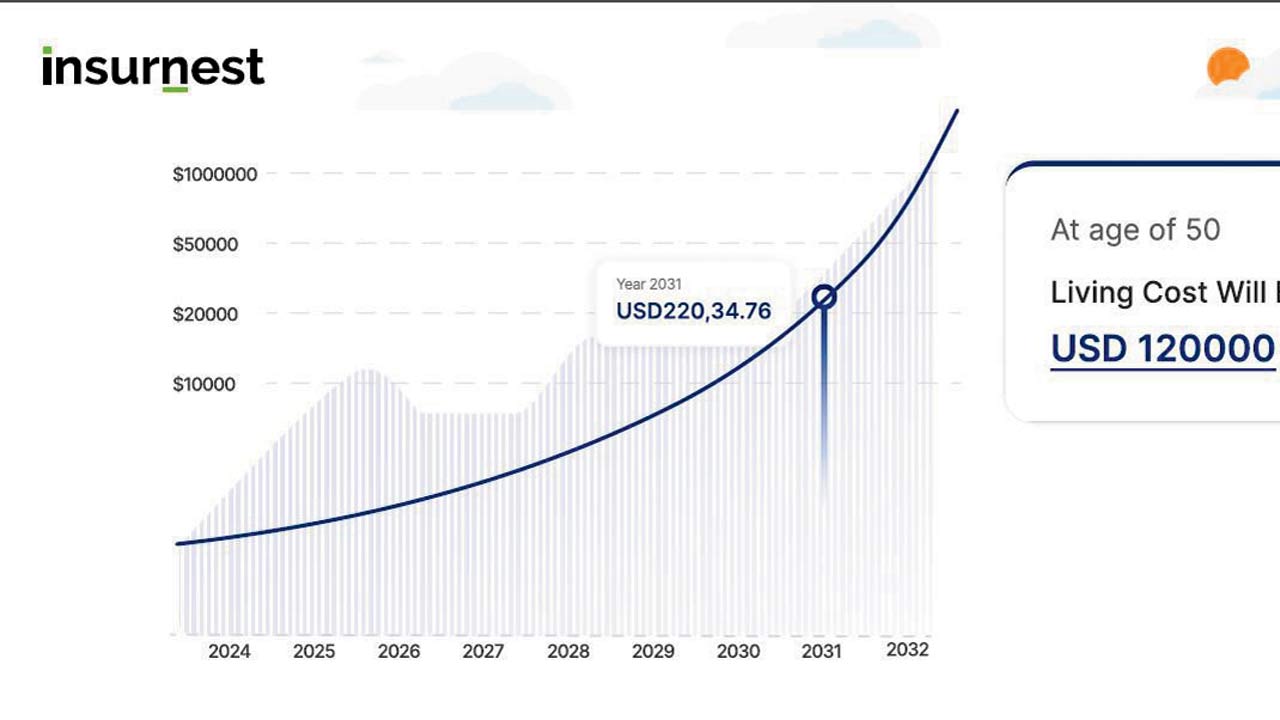

“Upon receiving an insurance quote from a life insurance agent, I found it difficult to understand due to numerous hidden terms and conditions. This challenge inspired me to create a personalised video that simplifies the information by eliminating unnecessary details, and customising elements like voice, interactions, clicks, and graphs. The video allows viewers to click anywhere for more information and includes real-life scenarios that explain the importance of buying term insurance, complete with personalised financial animations. For instance, it could illustrate the potential impact on a family if an insurance policy isn’t purchased in a timely manner,” he explains. This solution is also ideal for on-boarding customers, with AI assistance available directly in the browser while watching the video. The video can include a form that the AI helps to fill out, making the process seamless and user-friendly. This technology can help fintech companies explain their products more effectively and assist customers in the on-boarding process, ultimately enhancing customer understanding and engagement.

It customises elements like voice, interactions, clicks, and graphs, and presents real-life examples to help new customers understand the importance and the various parameters involved while getting insured

While the integration of AI into everyday life promises to revolutionise how we work, live, and interact, he believes that it also demands careful consideration of ethical and security challenges. Looking ahead, Mistry is confident. “AI innovation is progressing at an incredibly rapid pace, with new and improved models being introduced every month. Continuously adapting to these advancements can be costly and time-consuming. Instead of focusing solely on setting a precedent for future technology, we should prioritise how effectively we are solving business problems. The true value lies in delivering comprehensive solutions that address these issues thoroughly.”

What is it?

Three AI tools help companies manage recruitment process, appoint a chat bot as a 24/7 sales assistant, and create personalised AI videos for a better understanding of insurance quotations.

How it works?

The recruitment tool scores candidates based on their CVs without bias. Sales bot provides a 24/7 service and answer’s agents’ questions. The personalised AI video, on the other end, helps break down difficult jargon, and terms and conditions in insurance quotations, while presenting to the customer real-life examples.

Who it affects/benefits?

The aim is to help businesses tackle problems by effectively reducing time put into sales, hiring and forming personalised insurance pitches for on-boarding customers.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!